Back in August of 2021, I purchased 1 ETH worth of Hanzo Inu token based on a new strategy I was testing on picking moonshot tokens in their early days. Hanzo Inu was a fairly new token that had started back in May, it had the four qualities I thought made for a promising altcoin project (read more about that here).

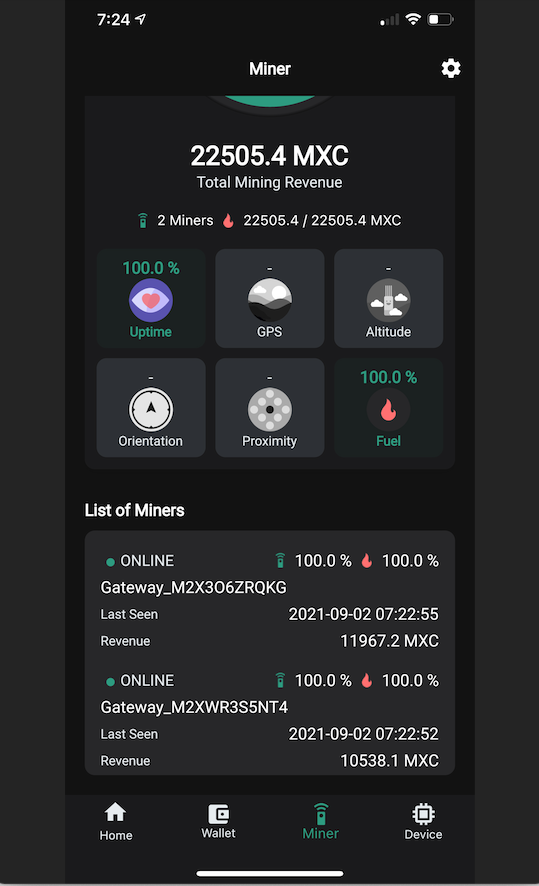

Eth was around $3000 USD at the time, so my investment has added nearly 10,000 USD to the ledger. That value has been holding–I waited two weeks before writing this article just to make sure that it wasn’t just a pump. This is no pump and dump–I’m convinced of that after spending the last couple of hours listening to the founder and the community team on their recent AMAs (Ask Me Anythings – see below).

What it has revealed to me was that the money I invested in the project was not wasted. In fact, I found that the community leaders are thoughtful, genuine and I’m excited about what I have to share today.

There is so much, let me start with a quick (tl;dr) overview.

- NFT Sale – Estimated for Mid-November. 8,888 to be released. Current holders to be whitelisted. ~200.00USD mint fee, and more.

- Marketing Plan and CEX Listings – Currently in negotiations. Send suggestions via Telegram or Twitter @HANZOINU

- MMORPG – Narrative in development, promising innovations with in-game tokens and NFTs.

- Game Contract Update – Contract needs development to expand, updates happening after NFT sale.

- Layer 2 Solutions + Bridging – Lots of potential, Bridging to BSC coming with fair matching on ETH.

- Partnerships – Possible, Hanzo team wants to maintain project and community integrity and foster growth long term. Will partner with true synergistic alliance rather than to make a quick buck.

During the AMA we got an amazing briefing given from Jebron and Sandy who are community leaders, early investors, and ultra-passionate about the project. We also heard from the founder, Charles during the event, who spoke about partnerships and the future of Hanzo. Overall, my sense was that the team is committed, driven, and has a great long-term perspective and vision for the project.

Marketing and CEX listings

Unless you’re BTC or ETH, getting listed on exchanges can be pricey. Currently, the team is negotiating or considering moving with a listing on Gate.io, FTX, and HotBit. All of this is tentative and dependent on a number of factors. Part of the funds the team plans on raising from the NFT sale is planned to be invested in listing on CEXes. There are still developments happening in the NFT space and a number of exchanges are adding NFT art to their service offerings. The plan is to find the right fit for the $HNZO token and the Hanzo NFT Art. What the leaders did promise was at least 1-2 CEX listings are forthcoming in the near future. More updates will follow.

NFT Art Sale

Jebron announced that the NFT sale would happen in Mid-November timeframe in two stages. The first stage will be a minting opportunity for early investors as they have plans to whitelist the folks who have truly HODLed and have been promoting the coin from the start. Being a part of the very early SHIB Army myself, I was a little disappointed I couldn’t mint my Shiboshi; so I’m pleased to see the team is planning a little reward for the folks who’ve been holding through the tough times we had during the summer. Ouch.

That said, there will be 8,888 NFTs released in a “Founder’s Collection.” 3,888 will be whitelisted for early adopters, and the other 5,000 will be released in a public sale. Hanzo NFTs will have 125 unique traits and expand on what an NFT can be in some interesting ways.

Additionally, there are some benefits for early minters such as:

- Participation in a beta-test round of the game

- Get access to special limited drops for minters

- In-game crypto may be involved

Sandy said that the Hanzo Inu NFTs will bring a new dimension to the NFT world. She was inspired by the artist’s work and thought the Hanzo NFTs would, “breathe a whole life into the [upcoming] game.” She stated that these NFTs are “crazy detailed”, and are a new full-body style. What’s even more incredible is that each full-body NFT of Hanzo will be made up of individual sub-NFTs like weapons, clothes, and accessories that can be used and traded in the game that will be released in 2022.

Hanzo NFTs will cost about $200.00 USD each during the initial sale, and the Founder’s Collection proceeds will go to furthering the project by hiring more staff to grow the project and to fund the upcoming game.

MMORPG – Game in development, Alpha version possible this year.

Both community leaders had updates for the game that is scheduled to be released sometime next year. Hearing Sandy describe the narrative and the vision for the game got me excited. Features that were described highlighted a new approach to the popular “Nintendo Party Games” where participants played together interactively in the game environment. Sandy and Jebron wanted to make it very clear that the new game will have complex gameplay and isn’t just a copy of previously done NFT or crypto-based games. The game will focus on social engagement, NFT art, creativity, and has a lot of dimensions using the Hanzo token for utility in the game.

What really stood out to me was the interesting and highly creative narrative. Sandy described it like, “a month-long festival that is going great until something happens and Hanzo is called to begin the journey.” The game changes from an MMO to an MMORPG and is similar to past dungeon crawler games (like Diablo) but with a crypto-twist. The loot collected in the game will be actual NFT art pieces that will be tradeable both on and out of the game environment.

If you’re not into gaming and just in it for the investment and/or NFT art collection, it doesn’t sound like you’re going to be disappointed since the value that Hanzo Inu is bringing to the marketplace soon will be interesting to watch.

Contract Update

I probably should have brought this up sooner, but honestly, it’s not as interesting as the other developments in this project so I’ll get to it now.

Charles and Sandy both stressed that the contract update is a necessary thing that will allow for proper growth and expanded functionality. Jebron noted that they needed a way to access marketing funds that won’t be pulling money out of the Hanzo Inu crypto-sphere. The contract will change reflections to ETH and be more easily used to purchase real-world marketing and other hard services that require fiat currency.

The contract update is going to be expensive but is being done to provide a solid foundation for the project moving forward. Updating to V2 is a priority and plans are to move forward on it after the NFT sale. I personally would expect it to happen early next year since we’ll be right up against the holidays.

Partnerships

Jebron and Charles both stated that they are looking ahead and planning on finding partners that make sense to partner Hanzo up with. While lots of things are possible, what stood out to me was that these leaders have personal integrity and want to add lasting value to the Cryptosphere, rather than doing a cash grab. They are currently in talks with some of the other projects out there and any partnership will be done with a holistic approach and will be focused on strengthening and supporting the community.

Conclusion: The Hanzo Inu Token Project is Solid

I don’t like to brag, but I told you so. This project is solid with a thoughtful and interesting team behind it. Getting in early is important on anything these days, but you have to do your homework and have some basic ways of converting the tsunami of data that is coming at us is crazy.

Projects like Hanzo are great examples of basic community building and creating a movement. The other value that it shows is hard work. With hard work, anything is possible. The timing of Hanzo is great because NFTs and Crypto both couldn’t be hotter. I think Hanzo is a winner with a huge value add through innovations and forward thinking.

Hanzo Links:

- Coin Market Cap: https://coinmarketcap.com/currencies/hanzo-inu/

- Hanzo Inu Contract Address: 0x239dc02a28a0774738463e06245544a72745d5c5

- Website: https://www.hanzoinu.ninja/

- NFT Game: https://www.hanzoinu.ninja/mmo

- Telegram: https://t.me/hanzoinu

- Twitter: @HanzoInu