Week #41 has been extremely interesting in the crypto world. On Wednesday, the Bank of England’s governor voiced his opinion that a lack of regulation in crypto markets could lead to a global financial crisis similar to the financial meltdown of 2008. In Moscow, Putin decided that crypto has value and is an acceptable form of currency, signaling that he believes the accumulation of Bitcoin will benefit his nation while threatening the dominance of the American petrodollar. And back in the States, Coinbase called on Congress to create a new regulator that monitors and manages crypto as an entirely different agency from Gary Gensler’s monolithic Securities and Exchange Commission (SEC). Gensler has been a champion of blockchain technology (teaching a class on it at MIT). We will see if he is a friend or foe of crypto.

On the one hand, crypto bulls are understandably nervous about the risks of over-regulating crypto; on the other, smart money knows that an industry that produces tax dollars becomes a politicians’ best friend. The stakes fly higher than a Himalayan eagle as crypto markets trek into the new rarified air of $2.4T USD.

How much more old money can crypto disrupt? There is over 60T USD on the cryptographic sidelines as we begin the move into Q4 2021.

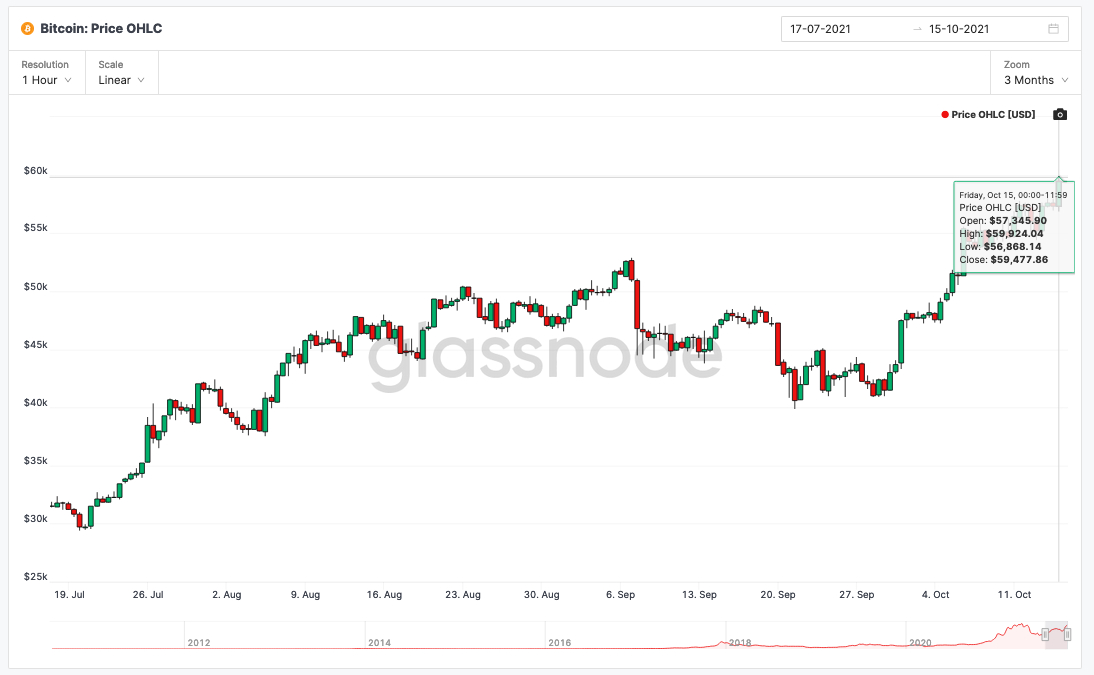

Like Will Shatner soaring boldly into space, we go boldly into the weekend. Investors have been rewarded with a new surge in BTC price above the $59k range and as we wait for Asia to come back online on Sunday. Something is brewing and it feels like everyone is holding on tight to see what kind of action Week #42 will bring. Will we seek new heights and soar above the previous ATH? Or, will we see a sell-off with a decline back into the 40s? Let’s get started!

Week 41 at a Glance

On-Chain BTC Forecast #40-#41 forecasted a slight downturn in pricing over the weekend with prices gradually bumping higher as we move into the “fall surge.” Aside from the fact that BTC pricing is currently above the 59k USD mark after a relatively flat week correlates strongly with last week’s forecast of lackluster gains at the start of the week with growth potential later on. However, It should be noted that the market has not produced price levels at these heights since May 2021.

Is the global crypto stage set for the new ATHs that many crypto experts tout? We’ll ask the tough questions in this week’s forecast.

Questions for the Week

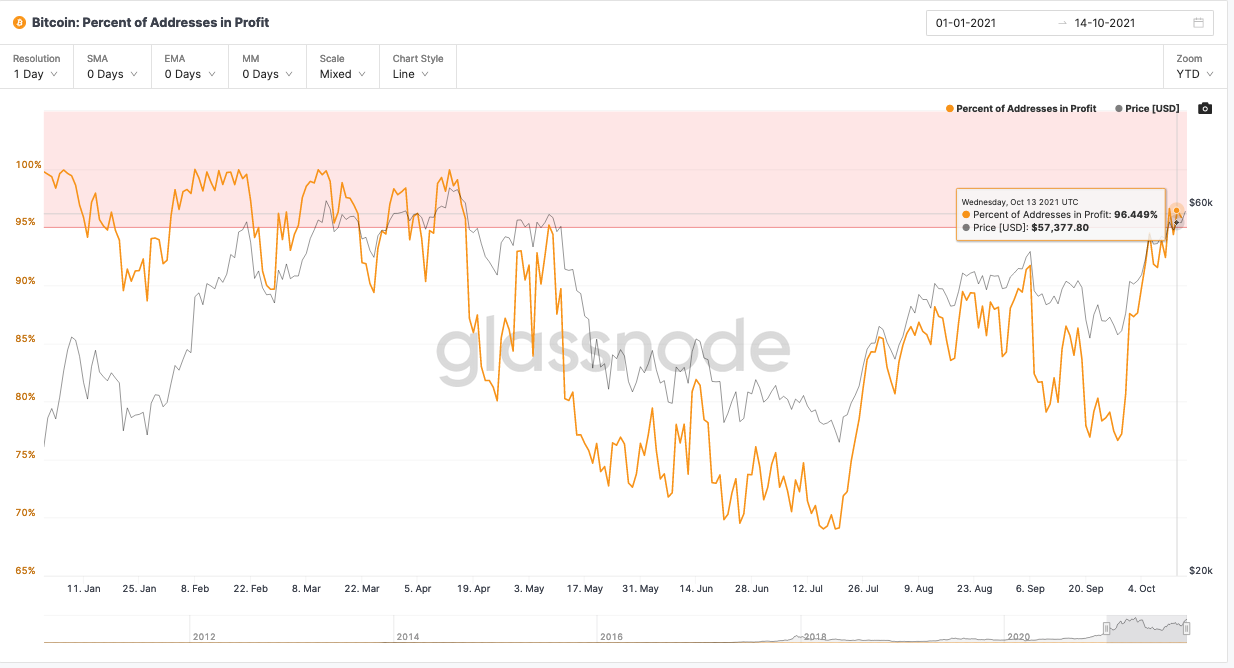

As older coins move into profitability, will investors take profits?

As we shift gears into a likely bullish cycle, we can see that a very large percentage (96%) of BTC addresses have finally moved into profitability. High price and profitability tends to create a psychological comfort zone for many, increasing the chances of HODLing for more gains. However, coins that were purchased back in the dips near the tops back in early spring have finally made it through the long summer months and are now becoming profitable. This will drive investors that are finally coming into profit to decide whether to stick it out for the potential rewards, or to get out when they can now.

Furthermore, looking at the total number of BTC that are in profitability, we find over 13M BTC in the money and classified as supply being held by Long-Term Holders (LTH). From this perspective, the market looks strong. We will soon see if HODLing behaviors persist in the near term, or otherwise if profitable coins will be cashed in. From a macro perspective, miners and HODLers as distinct groups tend to move with smart money and sell into strength. Let’s explore those groups as we consider what will happen next week. Overall, the market does appear to be coming out of a bear market with good consolidation in recent weeks, stepping us up into higher levels and setting up for a potential large move, aka, the “fall surge.”

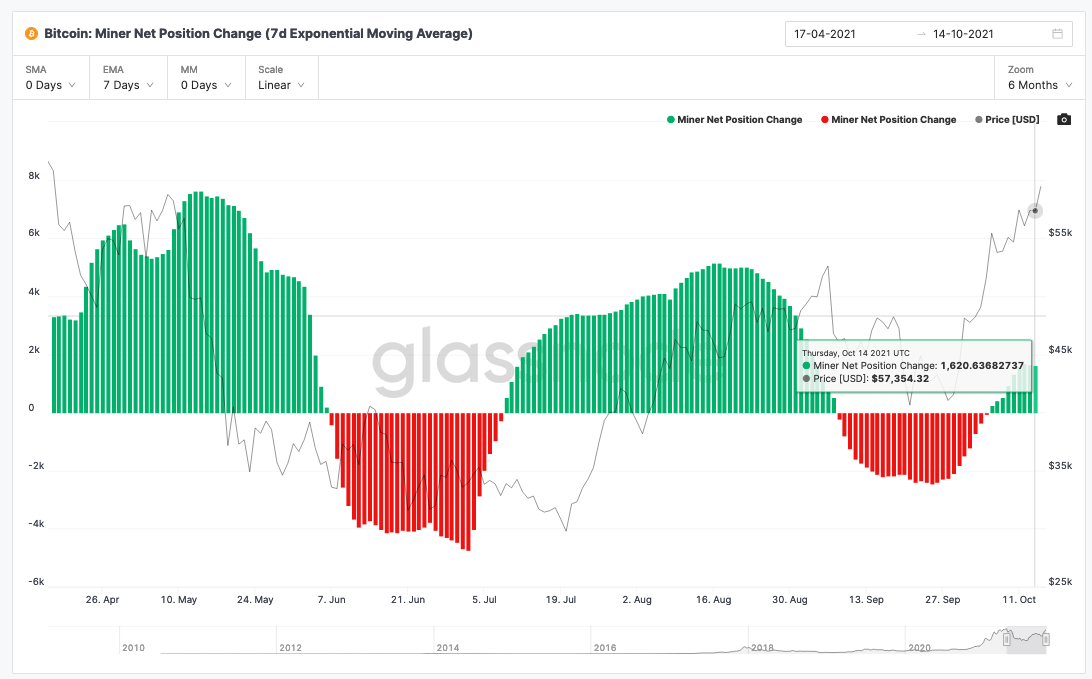

Will HODLers and Miners continue to accumulate?

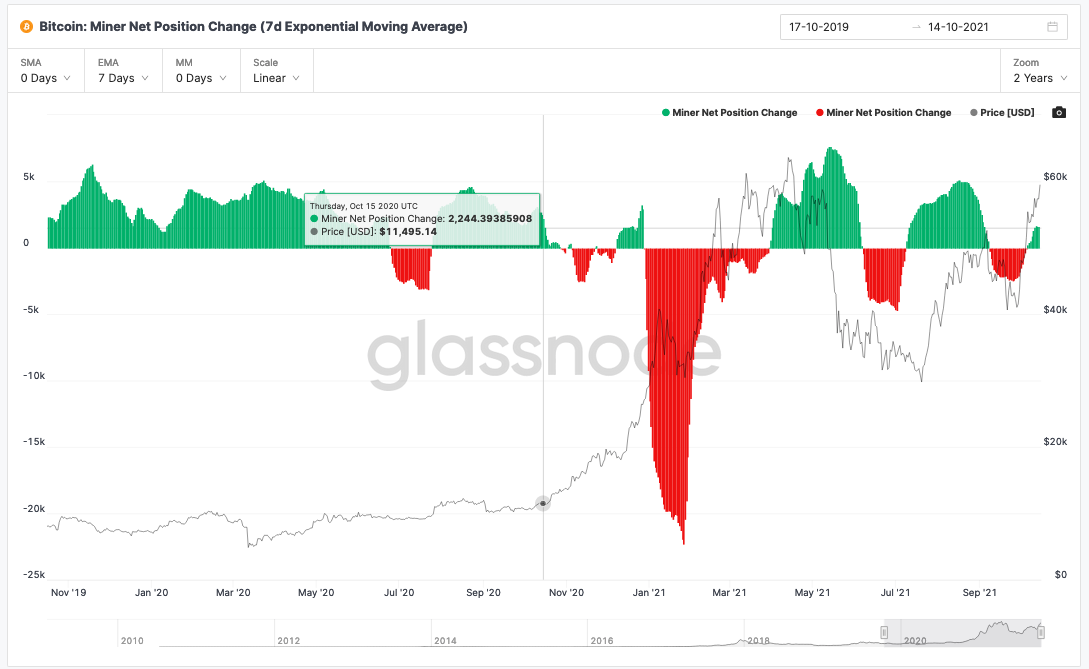

Miners are in an accumulation cycle, as confirmed by a 6-month snapshot of Miner Net Position Change.As we zoom out and look at this period last year, we spot a similar setup prior to growth.

Notice how as we moved into November (last year) miner’s positions had relatively little change then, as retail investors began to pile in, selling pressure increased and miners sold into strength as the price peaked in early spring. Currently, as excitement increases and more retail investors swing their attention to BTC, additional accumulation is expected as the market strengthens and we move into the late fall. Experienced miners know that the real boom comes when FOMO retail pours in, which it always does when BTC gets on a run long enough to grab the media’s attention.

HODLers are clearly accumulating and have been since the summer when prices were low. There was a short selloff in early August as profits were taken. During the first part of every month, miners and HODLers tend to sell coin to cover fiat expenses, but in this case it appears that a bit more volume moved as the market began to recover and we saw a upward trend in price as retail investors begin to move back into BTC.

All data up to this point indicates a strong market with growing interest.

Are retail investors joining the party?

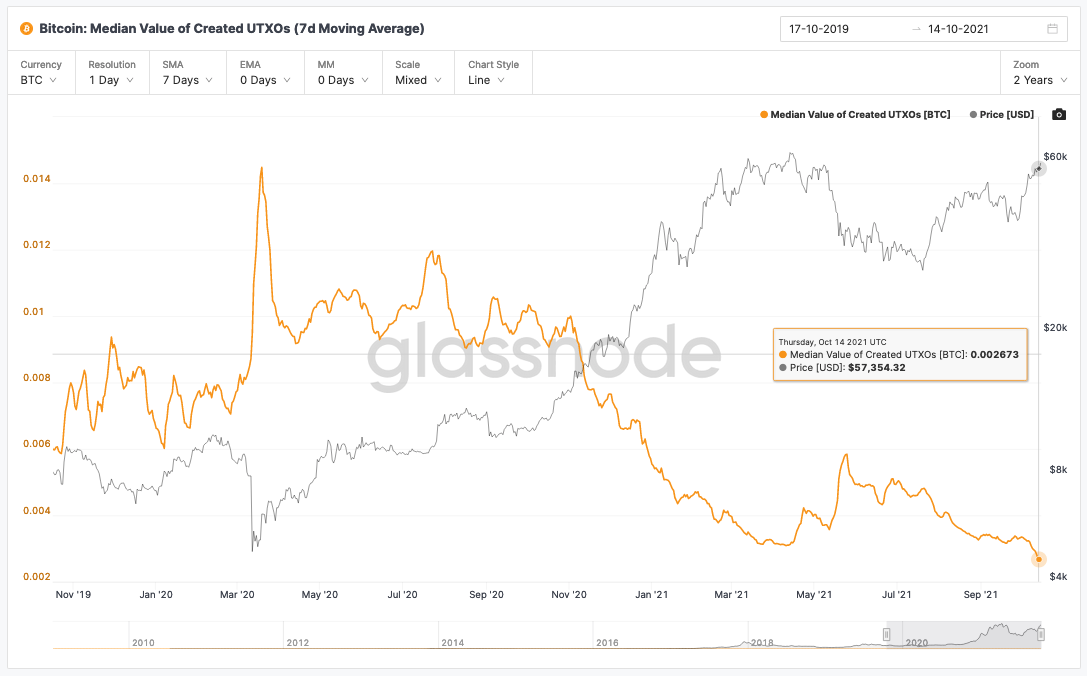

Median Value of Created UTXOs shows us the most typical transaction size that is being created at any given time. When someone buys or sells BTC, a UTXO is created with a value, and the median value shows us the price that most of the transactions have. We use median value as average value would skew to higher transaction sizes and give us a value that isn’t representative of a typical transaction. In other words, there is a downward trend in the median value of new UTXOs that are being created on-chain. Currently that median value is below $200.00 USD per transaction. During the summer months we saw accumulation by HODLers and there was an uptick in median UTXO that was triple the value it is now. What this means is that retail investors are coming in at lower price points and they are beginning to accumulate as the market heats up.

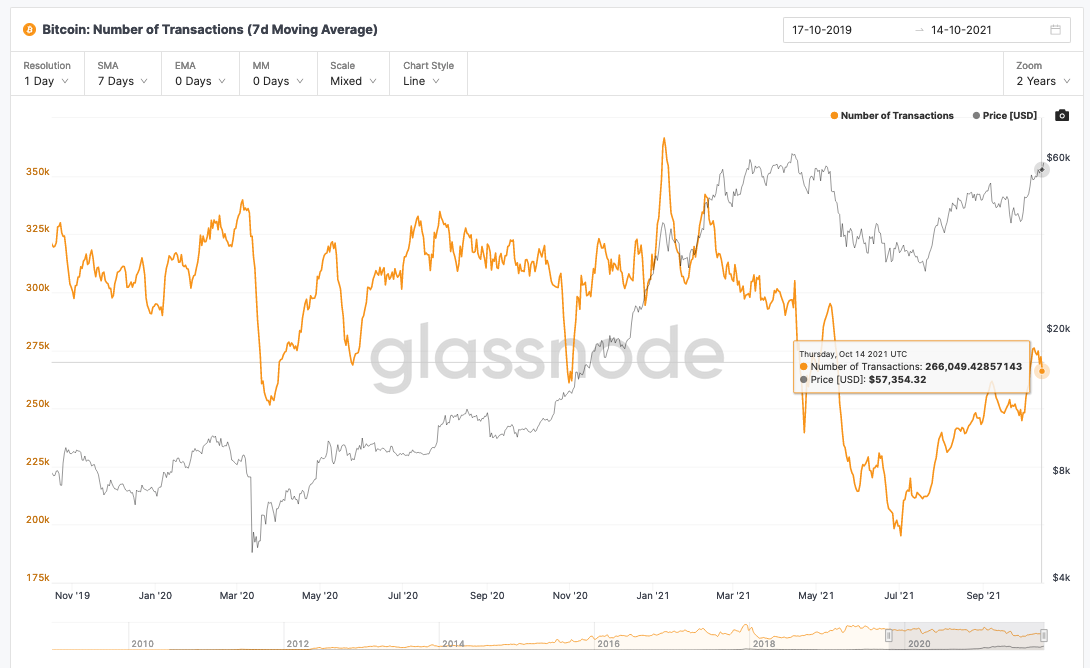

Going further and exploring the number of active addresses confirms that we are getting more retail players getting involved preparing as news circulates of higher pricing over the next couple of months.

As expected with more active addresses, we should see more activity, as confirmed by the on-chain data. This means more players are becoming more active as we recover from the last bearish cycle and prepare for a climb into higher price ranges later this year.

Next Week’s Forecast

Week #42 looks strong and prices are set to climb as accumulation behaviors persist. There is some risk with a great deal of profitable coins on the table, however, considering the time of year and the bullish sentiment present on nearly all social media platforms, HODLing is almost certain to continue in the near term as strength builds in the market. The forecast for next week is that the new heights achieved over the last week will consolidate and stabilize, with prices ranging in the high 50s with a strong potential to grow into the low-60s.

Later this Year

With strong levels of interest and growth of activity in the market, pricing is set to grow. The forecast remains consistent with the past reports with expectations of steady growth into the middle to upper 60s or higher later this year.